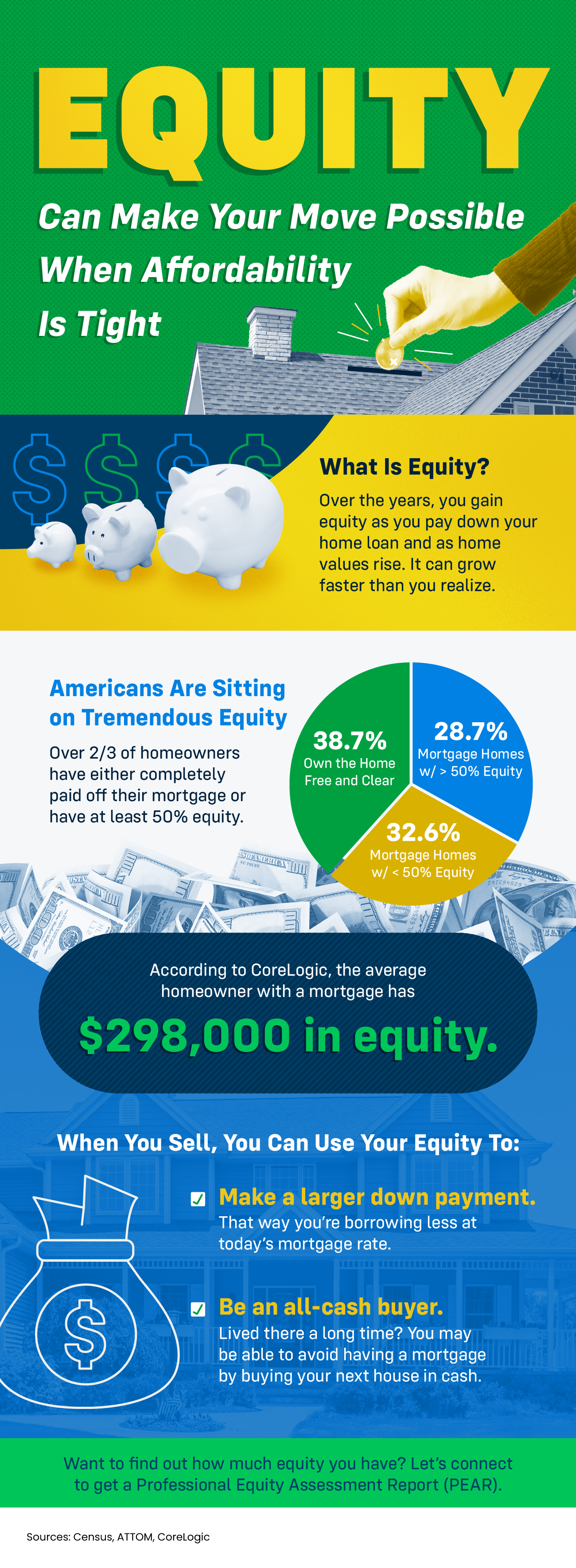

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_c12193ba-6d21-4f7b-95dc-00d7c8aa8a06.png)

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

Foundation Issues: What's Normal vs. What's a Red Flag

**Debunking the Myths: Why You Should Embrace VA Buyers**

Why Moving to a More Affordable Area Makes Sense

What Will It Take for Prices To Come Down?

Why More Sellers Are Hiring Real Estate Agents

Why This Winter Is the Sweet Spot for Selling

Why Owning a Home Is Worth It in the Long Run

When Will Mortgage Rates Come Down?

Sell Your House During the Winter Sweet Spot

Should You Sell Your House As-Is or Make Repairs?

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "